[ad_1]

My colleague Ben Carlson requested the query “Why Isn’t Inflation Falling?” There are some technical explanations, nonetheless earlier than we get there, a fast reminder as to how we bought correct proper right here:

The worldwide pandemic compelled governments throughout the globe to close their economies down; every little issue was closed, from faculties to companies, consuming areas, leisure venues, stores, and workplaces. It was a determined option to protect forward of a plague we had little understanding of on the time. Lastly, we discovered that vaccines and masking may assist us cope with the worst of this.

We fast-tracked vaccine approval and handed an vital fiscal stimulus in US historic earlier – 10% of GDP for CARES Act I. We rode out the pandemic at dwelling, doing our largest by Zoom and Teledoc, Pelotons and Netflix. We shifted our consumption habits from suppliers to things; fairly a couple of of us purchased properties and moved out of dense cities. World manufacturing strategies and provide chains proved insufficient to deal with the surge in demand.

Subsequently, a spike in inflation in 2021, accelerating into 2022.

As rapidly as herd immunity was achieved, the world started to slowly re-open, dare I say normalize? Many costs started to return as soon as extra all one of the best ways all the best way all the way down to earth: Lumber, Copper, USed Autos, Gasoline, Oil, Nat Gasoline, Sugar, Beef, Avocados, even Rooster Wings fell considerably from their peaks. Some commodities, like Lumber, returned to pre-pandemic ranges.

Nevertheless as Ben acknowledged, the sooner 7 month-to-month inflation prints (annualized) have ranged from 8.2% to 9.1%. There may be not an indication Shopper Value Indices costs are rolling over. (Claudia Sahm parts out PPI has peaked nonetheless it definitely nonetheless stays elevated). “Transitory” nonetheless appears to be like additional like wishful considering — and I’m on crew transitory.

What affords?

Because of it seems, a technical facet of how CPI is assembled is a huge a part of the rationale. It’s an oddity of how BLS assembles its CPI mannequin, searching for out methods to measure shelter which is each a value and for a complete lot of a whole bunch of house owners, an asset. Understanding this will likely enable you perceive why inflation seems to be so sticky, irrespective of an infinite swath of falling costs.

The info implies that many Objects costs, whereas significantly elevated over pre-pandemic ranges, is not going to be rising; positively, many have fallen dramatically. Inflation does appear to have peaked, so far as Objects are involved.

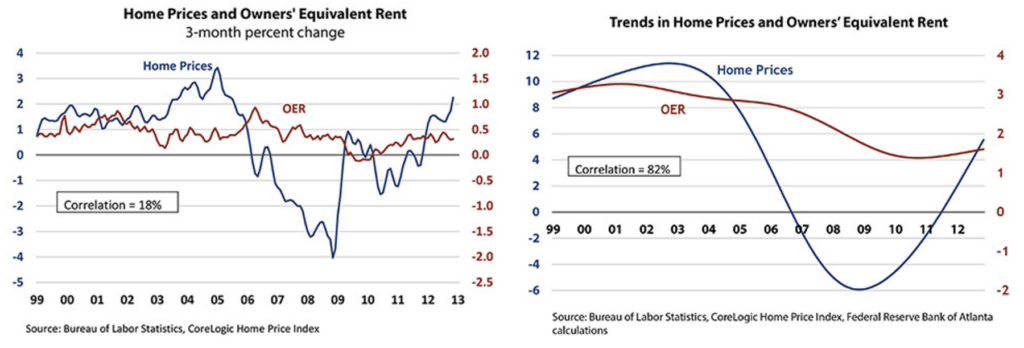

That leaves Companies. A really highly effective a part of Companies is Shelter (by far). Really, it’s the largest part of CPI, accounting for 32% of the index and ~40% of Core CPI. It’s calculated by a elaborate mannequin referred to as House owners’ Equal Lease (OER).

It doesn’t function one of many easiest methods it is attainable you will assume:

“Residence costs don’t immediately enter into the computation of the CPI (or the private consumption expenditures [PCE] value index, for that matter). It’s because of a house is an asset, and a rise in its value doesn’t impose a “worth” on the home-owner. However there’s a worth that householders face along with dwelling upkeep and utilities, and that’s the implied lease they incur by dwelling of their dwelling significantly than renting it out. In affect, each home-owner is his or her non-public tenant, and the lease they forgo every month usually referred to as the “house owners’ equal lease” (or OER) all through the CPI.”

-Mike Bryan and Nick Parker, MacroBlog, Atlanta Federal Reserve

This mannequin oddity has had massive outcomes on inflation over time. Observe the issue with OER is just not a mannequin new phenomenon, and the analysis uncover1 above was from 2013.

I first started discussing the impression of rental prices on CPI within the midst of the run-up to the monetary disaster all through the mid-2000s. As additional of us purchased properties, exact property costs skyrocketed, and fewer renters meant rental costs fell. Contained in the pre-GFC 2000s, quickly rising dwelling costs — pushed largely by reckless lending practices and quickly falling mortgage costs.– led to CPI displaying decrease than inflation really was.

It appears perverse, nonetheless that’s what occurred.

At present, we’re coping with a weird inverse variation of that state of affairs. Residence costs are rising, partly because of a lack of stock nonetheless exacerbated an outstanding deal by quickly rising mortgage costs. These costs are pushed primarily by the FOMC motion. The mix operates to worth many potential patrons out of the market. However you gotta reside someplace, and so these patrons are compelled to remain (or flip into) renters.

There’s a simple truism on the coronary coronary coronary heart of sticky CPI inflation readings:

Greater Fed Funds Costs & Mortgage Costs = Rising OER & CPI

In any case, that’s one of the best ways it appears to be working this cycle.

This leads us to the very perverse conclusion that because of the Federal Reserve makes an attempt to wrestle inflation by elevating costs of curiosity, it has led to greater CPI inflation every month, concurrently costs of merchandise have come down.

Even worse, the FOMC appears to be counting on the CPI to hunt out out when to cease elevating costs, concurrently they themselves drive these month-to-month CPI prints larger.

Rental costs are superior to mannequin, and their calculations are sometimes not so simple as surveying numerous landlords. As a substitute, it’s tied to dwelling costs, together with fully totally different components in OER sub-model. The Bureau of Labor Statistics and the Cleveland Fed are conscious of this anomaly. A contemporary analysis paper notes:

“Distinguished lease development indices generally give strikingly fully fully totally different measurements of lease inflation. We create new indices from Bureau of Labor Statistics (BLS) lease microdata utilizing a repeat lease index methodology and present that this discrepancy is type of completely outlined by variations in lease development for mannequin new tenants relative to the on a regular basis lease development for all tenants. Lease inflation for mannequin new tenants leads the official BLS lease inflation by 4 quarters. As lease is a crucial part of the patron value index, this has implications for our understanding of mixture inflation dynamics and guiding financial safety.”

-Brian Adams, Lara Loewenstein, Hugh Montag, and Randal Verbrugge

The excellent news is the analysis arms of the Fed and the BLS are conscious of this modeling draw again and seem like taking steps to deal with it. The damaging information is, I see no proof that the Federal Reserve itself has acknowledged its non-public function on this inflation complexity.

Contained in the unbelievable world of financial modeling, irrespective of falling costs, CPI has remained persistently larger, and we should at all times think about the function of the Federal Reserve as a part of the rationale why.

Would you’ve got ever guessed that Jerome Powell would turn out to be thought-about one in all many largest brokers of Inflation?

See furthermore:

Why Isn’t Inflation Falling? (Ben Carlson, October 21, 2022)

How All people Miscalculated Housing Demand (July 29, 2021)

Why the federal authorities took dwelling costs out of its principal inflation index (Timothy B. Lee and Aden Barton, Would possibly 11, 2022)

You Say You’re a Residence-owner and Not a Renter? Assume As quickly as further. (Mike Bryan and Nick Parker, March 11, 2013)

Beforehand:

Why Is the Fed Frequently Late to the Get collectively? (October 7, 2022)

Farewell, TINA (September 28, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Bloomberg: CPI Inflation Knowledge is a “Lie” (September 26, 2007)

Present:

Disentangling Lease Index Variations: Knowledge, Strategies, and Scope

Brian Adams, Lara Loewenstein, Hugh Montag, and Randal Verbrugge

US Bureau of Labor Statistics + Federal Reserve Financial institution of Cleveland, October 6, 2022

https://www.bls.gov/osmr/research-papers/2022/pdf/ec220100.pdf

_________

1. I assumed that was vital enough after I noticed it in 2013 to have mirrored it at The Large Image

[ad_2]