[ad_1]

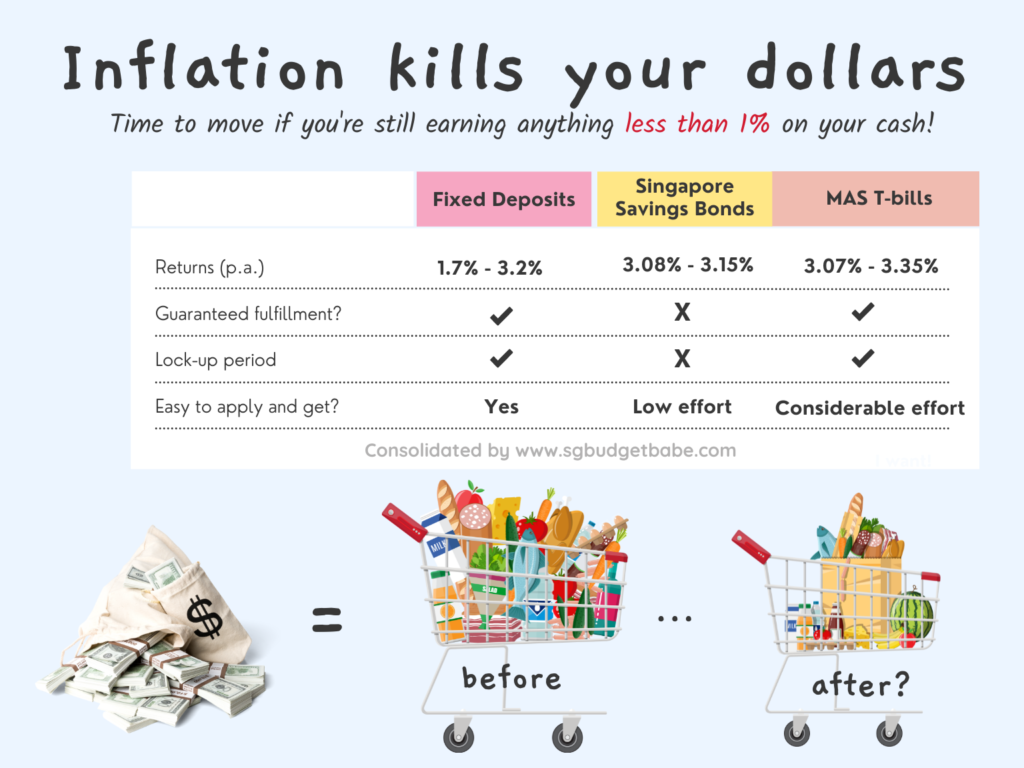

In case you happen to’re nonetheless incomes one factor lower than 1% in your money, it’s time to stand up and do one issue…prior to rising inflation erodes the value of your {{{dollars}}} any additional. Listed underneath are some gadgets likelihood is you will think about using, together with low-risk and capital-guaranteed ones.

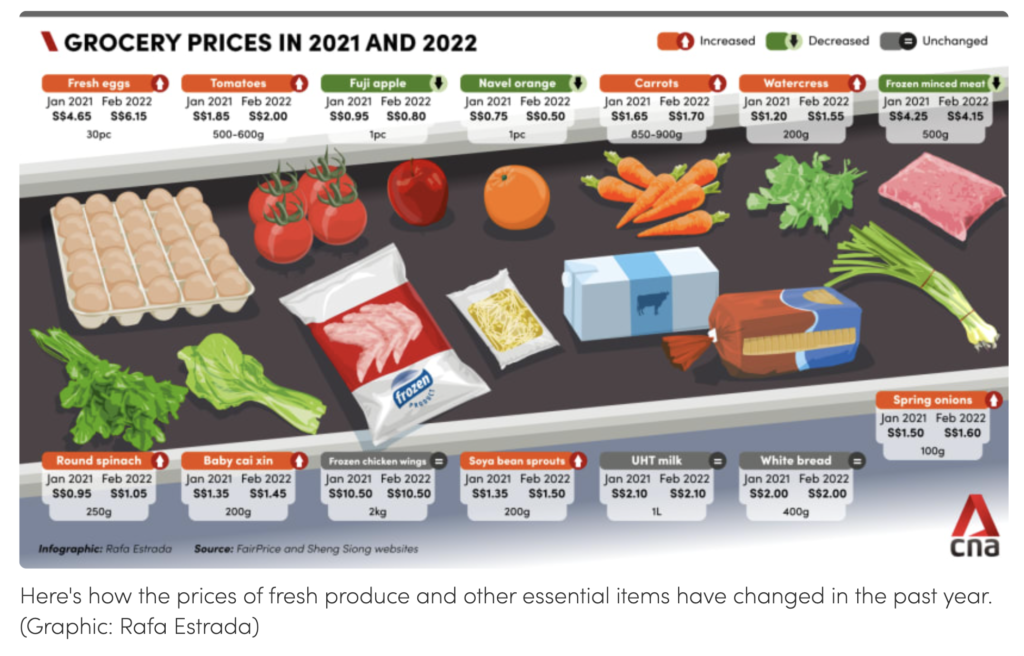

Inflation is horrifying. At first many individuals thought it is going to merely be momentary, given the availability chain constraints launched on by the pandemic and shortly, the Ukraine-Russia battle. However quick ahead to at present, and it’s clear that inflation isn’t going away anytime shortly. The massive query now’s, what’s going on to occur to our money, and the easiest way a great deal of it is going to probably be eroded by inflation? How masses can we nonetheless purchase in the long run if costs keep hovering?

For lots of savers, the risk-adverse and the conservative of us, investing the cash it’s best to have could seem to be a tough train. You could be concerned extra about dropping cash, nonetheless nevertheless it absolutely has gotten to the goal the place it isn’t ample to stash your financial monetary financial savings away every. What’s a saver to do when you don’t should make investments?

It troubles me to be all ears to that there are nonetheless an excessive amount of individuals who’ve nevertheless to differ to one amongst many fairly a couple of high-yield financial monetary financial savings accounts equipped by our native banks, and are nonetheless conserving their cash in an account that pays solely 0.05% p.a. Being lazy is one difficulty, and whereas that was acceptable inside the final word decade, your laziness and reluctance to differ will price you intently inside the approaching years should inflation ranges preserve elevated.

However I can perceive – the problem wanted to take care of up a high-yield financial monetary financial savings account isn’t one issue that each specific individual might be able to work for, and for some of us, there are nonetheless months the place you’re unable to qualify and hit the bonus curiosity, making it a colossal waste of your efforts.

In case you happen to think about your time is healthier spent doing one issue else than to leap by way of the hoops imposed by the quite a few banks, then on this case, I beseech you to on the very least ponder short-term saving devices that will pay you elevated than what your default checking account is supplying you with.

And there are numerous selections, too:

Mounted deposits

In case you happen to like the thought of merely heading to a financial institution and signing up for a tricky and fast deposit, then these are the quite a few selections likelihood is you will get right now:

- The shortest lock-in interval might be 1 yr, yielding 2.85% by Financial institution of China

- The right price might be 3.2% for a lock-up interval of two years, equipped by RHB

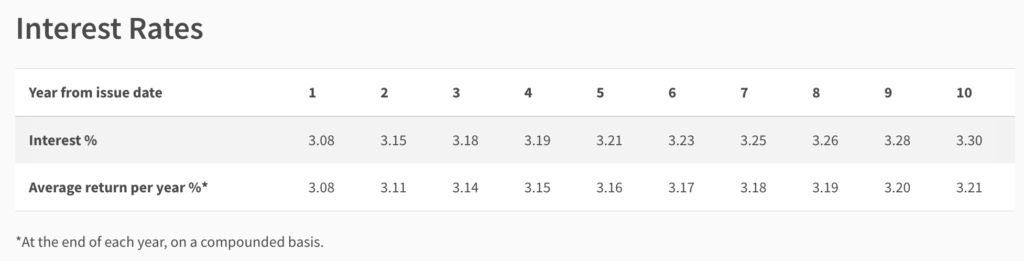

Singapore Financial monetary financial savings Bonds

If fastened deposits aren’t your cup of tea, then what relating to the Singapore Financial monetary financial savings Bonds? It’ll take barely extra effort to utilize for them, nonetheless nothing a 10-minute analysis apply (correct proper right here) will restore. Merely set your calendar reminders for the next utility date, get your money prepared, and apply on the ATM and even by way of your iBanking login, then hope that you just merely’ll get most allocation.

The beauty of the Singapore Financial monetary financial savings Bonds is that they supply extra liquidity than fastened deposits, as likelihood is you will cease and withdraw your funds all by means of the following month. In case you happen to hold your money there for the next 2 years, you get a median return of three.11% p.a. which isn’t too shabby in the least.

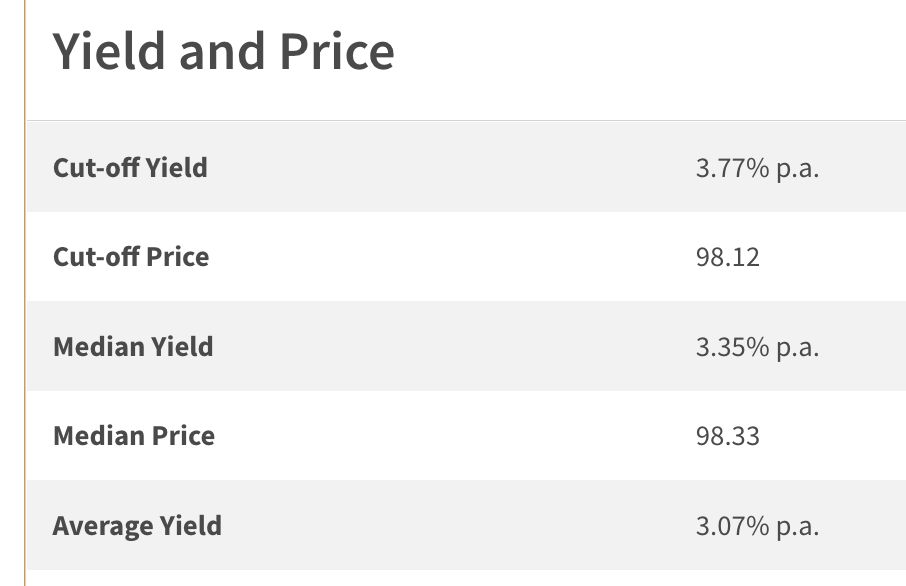

MAS T-bills

On the lookout for even elevated yields? Correctly, when you’re able to put in additional effort and onerous work, then the MAS T-bills may be right up your alley.

T-bills are barely extra troublesome to navigate, nonetheless when you play your having fun with enjoying playing cards right, likelihood is you will almost certainly nonetheless get the median yield of three.35% for the next 6 months, and while loads as the right cut-off yield of three.77% when you’re really fortunate.

The draw once more? Plenty of the extra collaborating T-bills are just for 6 months, so you will need to repeat the technique on the very least twice a yr, and constantly look out for the gear date to ensure you make it in time prior to it closes. Oh, and when you haven’t heard, most people sale course of is a bit more powerful to navigate, so merely watch out when you’re executing your public sale bid.

Nevertheless when the complexity areas you off, there’s one final straightforward danger that I can counsel: short-term fastened endowment plans.

Quick-term endowment plans

We’re no stranger to this software program program by now, and I’ve reviewed a number of first worth selections correct proper right here on this weblog as efficiently. And proper now, I’ve caught wind of the fact that Good Japanese has merely launched their newest GREAT SP Sequence 9.

Disclosure: Good Japanese has kindly invited me to do a overview and rationalization of their newest providing, and the following half is sponsored by them.

Key Particulars:

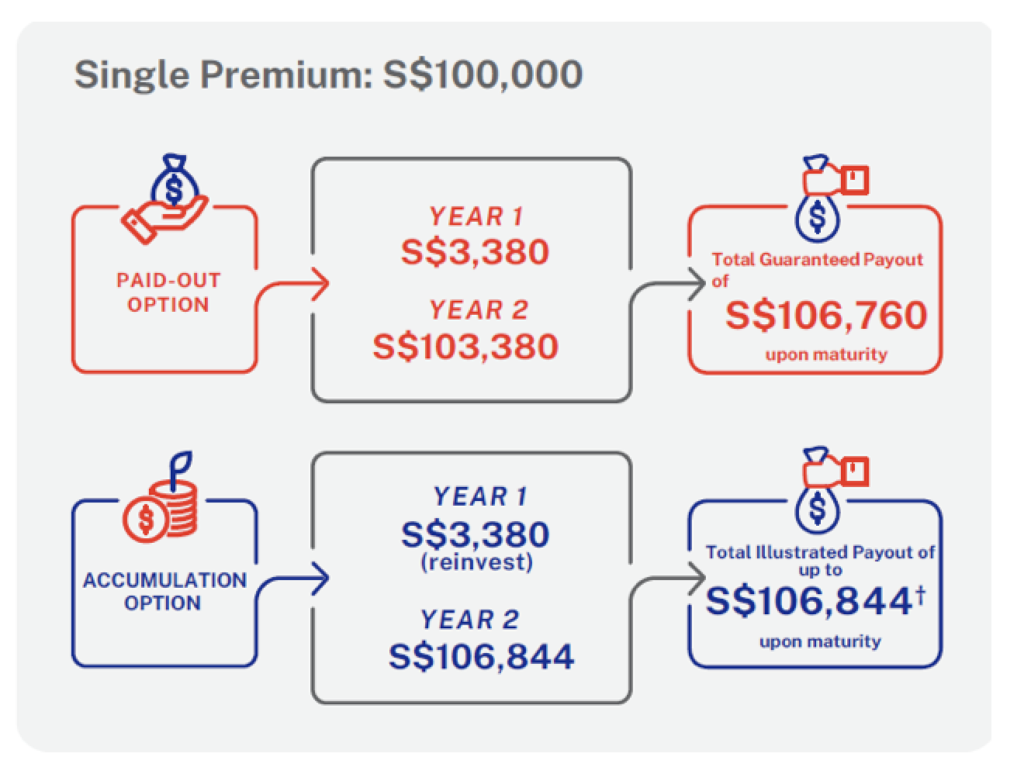

- A 2-year single premium endowment plan, with a minimal of $10,000 to utilize

- Assured returns of three.38% p.a*. upon maturity

- Assured payouts on the top of every of the 2 safety years

- Capital assured, upon maturity

- Furthermore provides insurance coverage protection safety security in opposition to dying and full everlasting incapacity

This may presumably be a fairly danger when you don’t concepts the 2-year safety time interval.

In case you happen to ask me, one technique to take care of this might presumably be to place in cash you seemingly gained’t want for the next 2 years, and select the buildup danger (which reinvests your payout) so that you just merely’ll get elevated returns on the top of the dimensions.

*Assured survival income equal to a couple.38% of the one premium might be payable yearly on survival of the life assured on the top of every of the 2 safety years.

† This resolve is matter to rounding and depends upon the prevailing accumulation worth of curiosity of two.50% yearly on money payout. In quite a few phrases, once you select the buildup danger, your first yr payout might be reinvested at an worth of curiosity of two.50% yearly (not 3.38%). Based totally completely on accumulation worth of curiosity of 1.00% yearly on money payout, the entire illustrated payout at maturity is S$106,793. These bills usually aren’t assured and might be modified every so often.

The quantity of effort wanted? Minimal.

Software program program is fairly easy and you can do it on-line inside a few minutes. There’s furthermore no want to observe altering public sale/issuance dates, observe its progress, or fear about having to attract out your cash in 6 months – 1 yr time and uncover the next finest instrument one different time to rotate it to.

As we’re in a rising expenses of curiosity surroundings, likelihood is you will be considering whether or not or not it is price getting this…what if expenses of curiosity rise additional tomorrow?

The problem is, none of us can predict the long term, nonetheless we’re going to really take steps to develop our wealth.

What if expenses of curiosity rise additional tomorrow?

Correctly, when you’re of the view that expenses of curiosity might be elevated from subsequent yr onwards, then allocate your cash accordingly between the quite a few selections I’ve shared up to now. You could possibly then should put extra into liquid selections like SSBs, and fewer of your cash into devices like fastened deposits or Good Japanese’s GREAT SP Sequence 9.

However when you’re of the view that expenses of curiosity will not rise considerably elevated from correct proper right here, then what about doing the selection? i.e. put extra into elevated yielding selections – like Good Japanese’s GREAT SP Sequence 9 – which might assure you a sure diploma of return, and the remainder of your cash in additional liquid selections like SSBs or T-bills so it’s best to have easy accessibility to withdraw at anytime.

Conclusion

Too many individuals are nonetheless incomes lower than 1% (or worse, merely 0.05% p.a.) on their cash at present, which matches to be an infinite draw back shortly if they don’t stand up and alter their monetary habits. With the costs of meals, electrical vitality, water, mortgage expenses of curiosity and completely completely different life-style necessities rising…can your wage rise quick ample to maintain up up, and will your financial monetary financial savings be capable of proceed offering you the extent of security that it used to have the facility to?

On the top of the day, even for savers and the risk-adverse who aren’t eager on investing your cash, I wanted to spotlight that there are nonetheless an excessive amount of selections out there available on the market that will help you to deal with inflation and stop the value of your cash from being eroded too masses.

It’s solely a matter of what you need. And when you’re not too optimistic, then I actually assume the most recent Good Japanese’s GREAT SP Sequence 9 is price contemplating – considerably with assured returns of three.38% p.a. upon maturity.

And now, the ball is in your court docket docket docket. Go forth and select the strategies that finest be merely finest for you.

Psst, such tranches are commonplace and have a tendency to promote out rapidly, so please act quick when you’re hoping to protected a portion of this tranche to your self.

Attempt extra particulars on GREAT SP Sequence 9 correct proper right here.

Disclosure: This publish is delivered to you in collaboration with Good Japanese, who fact-checked the supplied product particulars about GREAT SP Sequence 9. All opinions on this publish are mine.

The information launched is for basic information solely and doesn't have regard to the precise funding targets, monetary state of affairs or specific wants of any specific specific individual. As looking for a life insurance coverage protection safety safety is a long-term dedication, an early termination of the safety sometimes consists of utmost prices and the give up worth, if any, that's payable to you could possibly be zero or lower than the entire premiums paid. You presumably can want to go looking recommendation from a monetary adviser prior to making a dedication to buy this product. In case you happen to choose to not search recommendation from a monetary adviser, it's best to ponder whether or not or not or not this product is suitable for you. Protected as loads as specified limits by SDIC. Data is suitable as 26 October 2022. This industrial has not been reviewed by the Financial Authority of Singapore.

[ad_2]